Navigate Your Online Income Tax Return in Australia: Crucial Resources and Tips

Browsing the on the internet tax return procedure in Australia needs a clear understanding of your obligations and the sources offered to streamline the experience. Crucial papers, such as your Tax Obligation File Number and income statements, need to be carefully prepared. Picking an appropriate online platform can substantially impact the efficiency of your filing procedure.

Understanding Tax Obligations

People should report their earnings precisely, which includes incomes, rental earnings, and investment incomes, and pay tax obligations as necessary. Residents have to understand the difference between taxed and non-taxable income to make certain compliance and enhance tax obligation end results.

For companies, tax responsibilities incorporate several facets, including the Goods and Services Tax Obligation (GST), company tax obligation, and pay-roll tax. It is important for services to register for an Australian Business Number (ABN) and, if applicable, GST registration. These responsibilities require meticulous record-keeping and timely entries of tax returns.

Furthermore, taxpayers ought to be acquainted with available reductions and offsets that can alleviate their tax obligation problem. Consulting from tax obligation specialists can supply important insights right into maximizing tax obligation placements while ensuring compliance with the legislation. Generally, an extensive understanding of tax commitments is essential for efficient financial planning and to prevent charges connected with non-compliance in Australia.

Essential Documents to Prepare

In addition, assemble any relevant bank statements that mirror interest revenue, in addition to returns statements if you hold shares. If you have other resources of earnings, such as rental properties or freelance work, ensure you have documents of these earnings and any associated expenses.

Take into consideration any type of private wellness insurance coverage statements, as these can influence your tax commitments. By gathering these essential records in advancement, you will simplify your on the internet tax obligation return process, decrease errors, and maximize prospective refunds.

Selecting the Right Online System

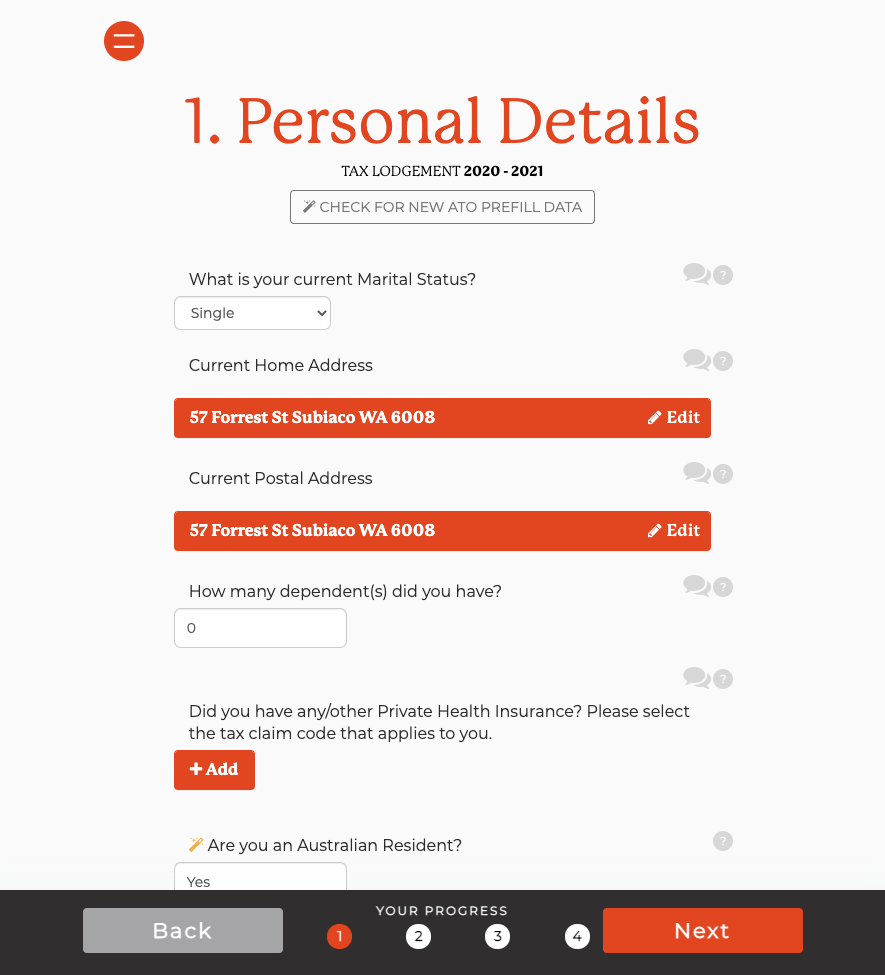

As you prepare to file your on-line tax obligation return in Australia, picking the best platform is necessary to ensure accuracy and simplicity of usage. An uncomplicated, instinctive design can considerably improve your experience, making it less complicated to browse intricate tax forms.

Next, evaluate the platform's compatibility with your monetary circumstance. Some services cater especially to people with straightforward income tax return, while others provide extensive support for much more complicated situations, such as self-employment or financial investment earnings. Moreover, try to find systems that use real-time error checking and assistance, helping to reduce mistakes and guaranteeing compliance with Australian tax laws.

One more essential aspect to consider is the degree of consumer support available. Reputable platforms should give accessibility to help through e-mail, phone, or chat, particularly throughout height filing durations. Furthermore, research customer evaluations and ratings to determine the general complete satisfaction and reliability of the system.

Tips for a Smooth Filing Refine

If you adhere to a few vital ideas to ensure effectiveness and accuracy,Filing your on-line tax return can be an uncomplicated process - online tax return in Australia. Collect all required records before starting. This includes your revenue statements, invoices for reductions, and any various other relevant documents. Having whatever available reduces errors and disruptions.

Following, capitalize on the pre-filling function offered by lots of on the internet systems. This can conserve time and reduce the chance of mistakes by immediately occupying your return with info from previous years and information given by your company and banks.

Additionally, confirm all entrances for accuracy. online tax return in Australia. Errors can bring about postponed reimbursements or concerns with the Australian Taxes Workplace (ATO) See to it that your individual information, revenue numbers, and reductions are right

Filing early not just decreases stress yet also permits for check this site out much better preparation if you owe taxes. By following these ideas, you can navigate the on-line tax return procedure smoothly and with confidence.

Resources for Support and Assistance

Navigating the intricacies of online income tax return can in some cases be daunting, yet a variety of sources for assistance and support are conveniently available to aid taxpayers. The Australian Taxation Office (ATO) is the key source of info, offering detailed overviews on its site, consisting of FAQs, training video clips, and live chat choices for real-time aid.

Additionally, the ATO's phone assistance line is available for those who like direct communication. online tax return in Australia. Tax obligation specialists, such as registered tax representatives, can additionally give individualized assistance and ensure compliance with present tax obligation regulations

Final Thought

To conclude, successfully browsing the on-line tax obligation return procedure in Australia calls for a comprehensive understanding of tax obligations, precise preparation of vital files, and cautious selection of a suitable online platform. Abiding by practical pointers read what he said can boost the declaring experience, while offered resources provide valuable assistance. By coming close to the procedure with persistance and interest to detail, taxpayers can ensure conformity and make best use of possible benefits, ultimately adding to an extra effective look at this site and effective tax return outcome.

As you prepare to submit your on the internet tax obligation return in Australia, choosing the right system is important to make certain accuracy and convenience of use.In verdict, efficiently browsing the online tax obligation return process in Australia needs a comprehensive understanding of tax obligation obligations, careful preparation of vital documents, and cautious option of an appropriate online system.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!